We keep you updated with the latest news from Martin Hood and helpful information whenever there is a change to employment or tax laws.

March 5, 2018

With the complex new lease accounting standards, many companies are seeing issues with the changes.

Below is the bulk of an article pulled from Accounting Today that addresses this topic:

Three quarters of companies find the new lease accounting standard set forth by the Financial Accounting Standards Board to be more complex than expected.

The FASB standard, released in 2016, requires organizations that lease assets to recognize on the balance sheet the assets and liabilities for the rights and obligations created by those leases. For some companies, this has meant the need to rely on more sophisticated accounting software that provides the ability to perform more complex calculations and reports.

Many real estate and equipment leases, previously often disclosed only in the footnotes of investor filings, will now be capitalized on corporate balance sheets. The International Accounting Standard Board estimates that over $2.2 trillion of assets and liabilities will transfer onto corporate balance sheets in the coming years.

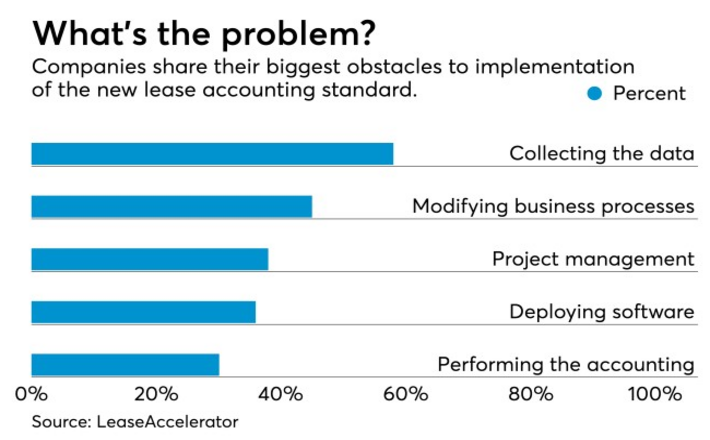

While 75 percent of companies reported more complexity than expected in a recent survey, just over a third have taken the step to select a software solution to address the problem. Deploying software to is an obstacle to implementation of the standard for just over a third of companies, but collecting data, also a problem solvable with software, is the biggest obstacle, with almost 60 percent of companies reporting that as their stumbling block.

The survey also revealed that 75 percent of companies are finding the new leasing standards to be just as complex or more challenging than the new revenue recognition standard.

Despite the trouble with FASB compliance, 54 percent of companies are on schedule with their lease accounting projects. Just over 20 percent are behind schedule.

The most difficult leases to analyze for the new lease accounting standard, according to more than half of survey respondents, are those embedded in service contracts and outsourcing agreements.

“With revenue recognition projects winding down companies are now turning their full attention to the lease accounting standards,” stated Michael Keeler, CEO of LeaseAccelerator, which conducted the survey. “And project teams are discovering that it is not the accounting that presents the greatest challenge with compliance, but rather issues such as business process transformation and data collection that organizations are struggling with the most.”

If you have questions and/or are struggling with this issue in your company, give us a call to discuss.